option to tax form uk

For a copy go to wwwgovuk and search for VAT 742A. Opting to tax is quite easy.

Ad Self Assessment doesnt need to be painful.

. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. In fact she simply charged VAT on rents thinking the property was taxable and never submitted an Option to Tax to HMRC. Get it sorted today.

VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. HMRC assessed Mrs Harris for the VAT due on the. Option to tax.

Rent it out without opting to tax and you wont be able to claim the VAT back. Our UK accountants can file your tax returns for you 100 online. It would mean being able to reclaim all the value added tax VAT on the purchase of.

Choosing the correct formIf your business buys or rents out a non-residential property you may want to make an option to tax election to save VAT. However the ability to sign these forms electronically has been made permanent. Looking for the best All-in-one PDF Editor online.

What is the Option to Tax. We file your Tax Returns for you all online. If you do opt to tax you will need to charge the tenant.

Save Money and Time with PDFfiller. Beforeyou complete this form we recommendthat you read VATNotice 742A Opting to tax land and buildings goto wwwgovukand search for VAT Notice 742A. If you are notifying us of a decision to opt to tax land and.

Opting to tax land and buildings. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on. For example you need a VAT 1614A in a different situation to a VAT 1614D.

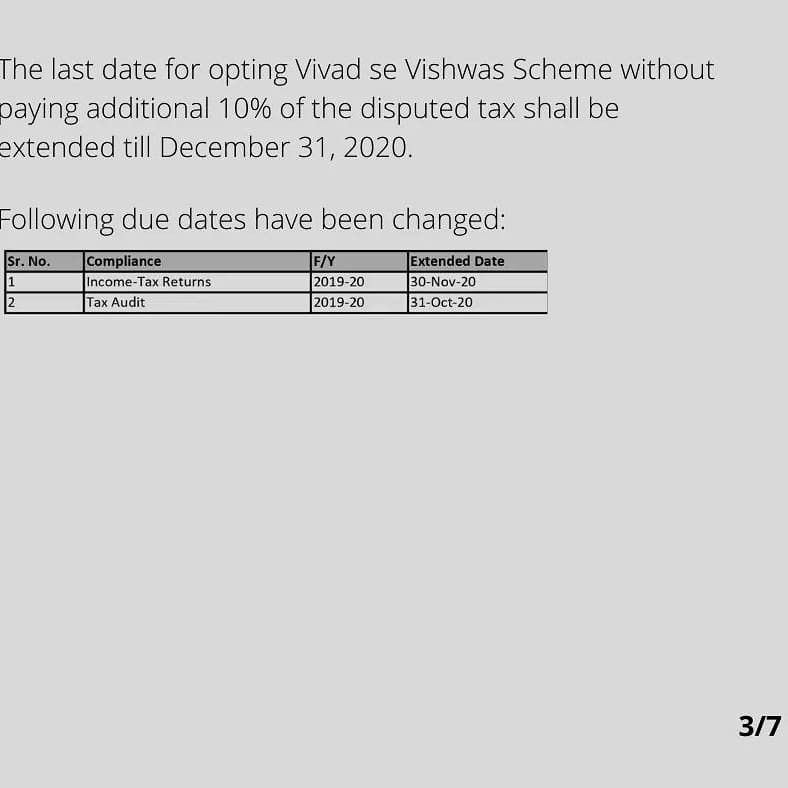

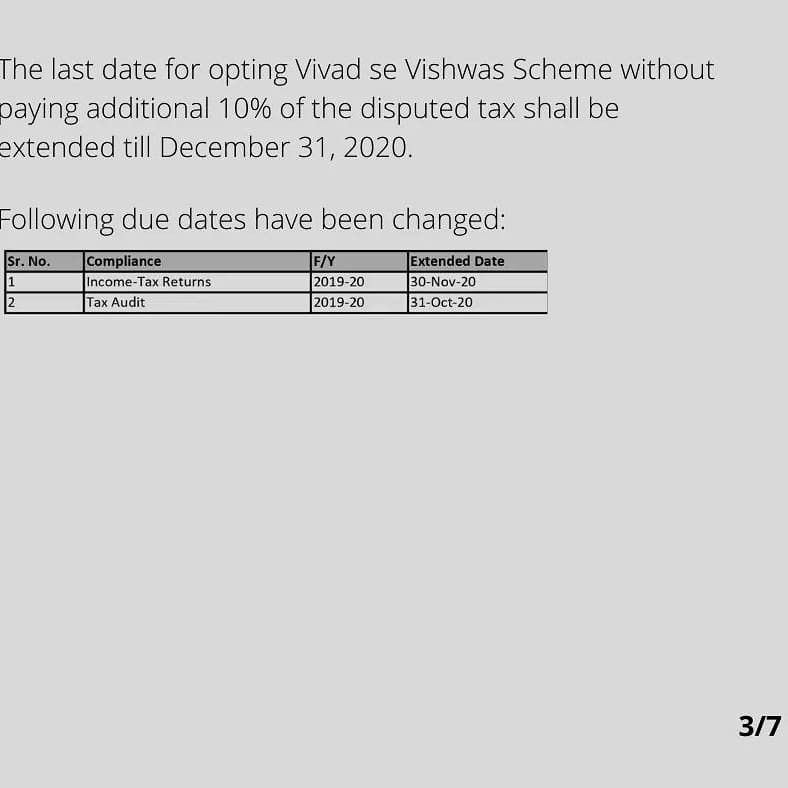

The temporary change to the time limit to notify HMRC of an option to tax during coronavirus COVID-19 has ended. VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was made Obtaining permission from HMRC in some.

I tend to remember option to tax forms by their numbers and letters. Form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are. Claim a refund of Income Tax deducted from savings and.

As it is a new commercial property you will be charged VAT. The time limit for notifying an option to tax has returned to 30 days from 1 August 2021. To make a taxable supply out of what otherwise would.

The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie. Before you complete this form we recommend that you read VAT Notice 742A. Ad Download Or Email HMRC P85 More Fillable Forms Register and Subscribe Now.

Use this form only to notify your decision to opt to tax land andor buildings.

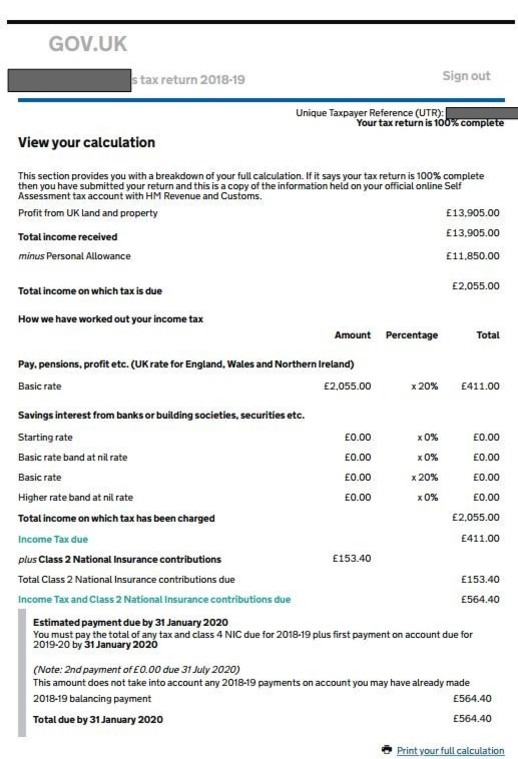

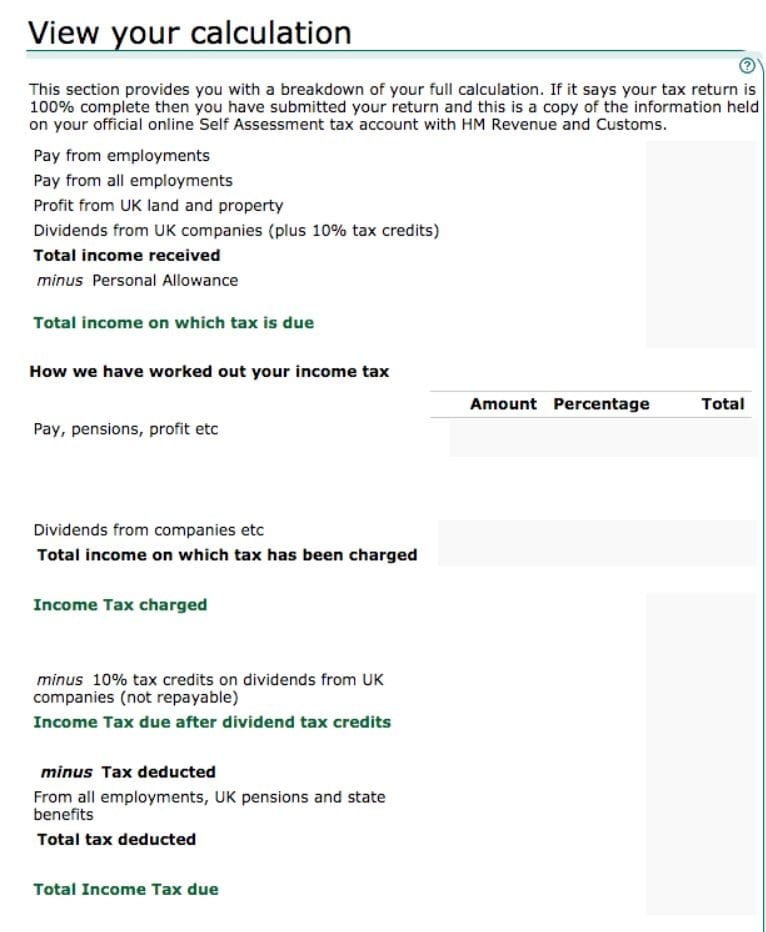

How To Get Your Sa302 Form Tax Overview Online Goselfemployed Co

Amp Pinterest In Action Business Proposal Template Proposal Templates Business Analysis

How Do I Add A Tax To My Business Tax Account Youtube

Income And Expense Spreadsheet Excel Small Business Finance Etsy Uk Expense Tracker Excel Small Business Finance Etsy Seller Planner

How To Get Your Sa302 Form Tax Overview Online Goselfemployed Co

Residential Tenancy Agreement Template Uk Rental Agreement Templates Tenancy Agreement Contract Template

Welcome To Astons Accountants A Company Which Provides Accounting Services Which Include Tax And Vat Instructions We Accounting Services Accounting Business

How To Tax Your New Car Online With Green Slip V5c 2 2020 Gov Uk Youtube

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

Taxes Deadline Or Tax Time Notification Of The Need To File Tax Returns Tax Form At Accauntant Workplace In 2022 Tax Deadline Tax Services Filing Taxes

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

2009 Form Uk Hmrc Vat1614j Fill Online Printable Fillable Blank Pdffiller

Uk Hmrc Vat1614a 2009 2022 Fill And Sign Printable Template Online Us Legal Forms

Apply For Spouse Visa Today Get Fast Visa Processed With Friendly Consultation At Affordable Price Please Look At The Check Visa How To Apply Family Problems

Pin By Mohit Jha On The Tax Consultants Income Tax Return Tax Return Income Tax